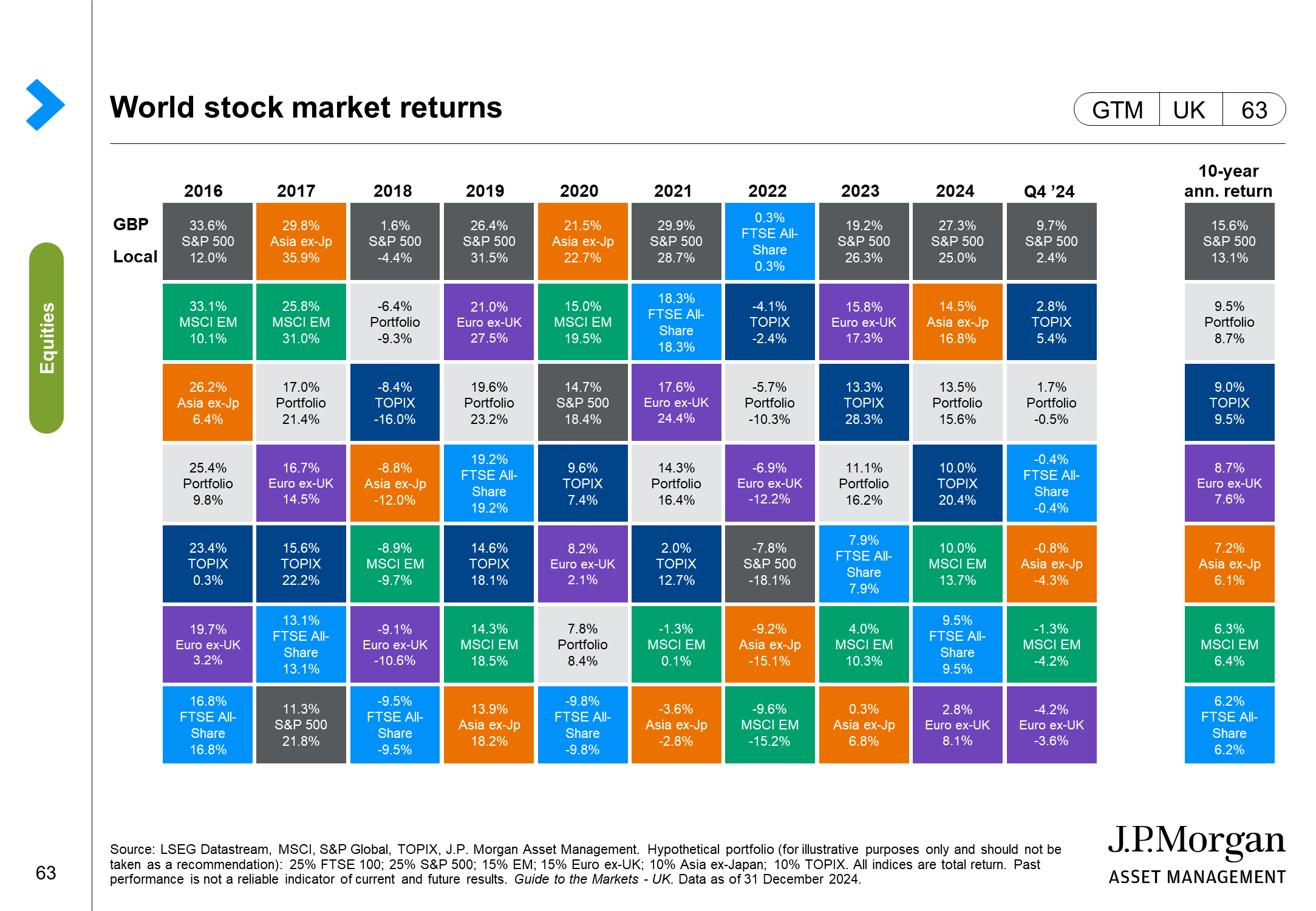

2024 was another strong year for equities.

The FTSE All World Index closed the year up 19.9%. This masked though some large regional differences as you can see from JP Morgan’s Guide to the Markets.

The US S&P 500 closed up 27.3% (in GBP), followed by Asia ex Japan all the way down at 16.8%. Other markets underperformed significantly with Europe ex UK being the worst performer only managing 2.8% (in GBP). The UK FTSE All share also underperformed the world index returning 9.5%. US companies such as Nvidia , the specialist chip maker,produced stellar stock performances on the back of significant earnings upgrades from global investment into Artificial Intelligence infrastructure. The US index was also boosted after Trump’s victory as the market expects lower tax rates and less regulation with the stock of Tesla doing particularly well, whose founder Elon Musk was a major Trump donor and supporter.

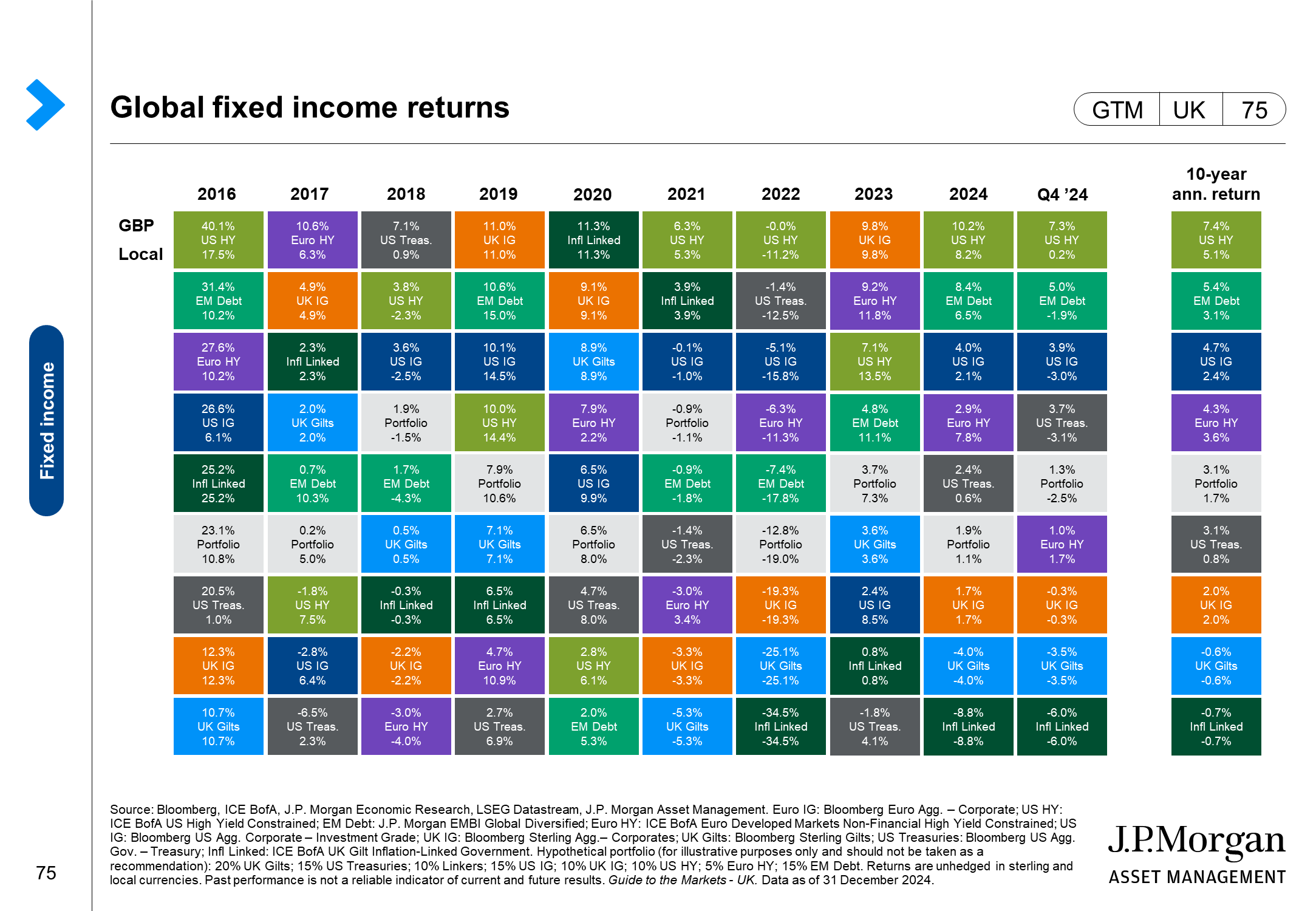

Global government bonds were a different story. Even though governments around the world have started to cut interest rates which were too high after inflation came down after Covid, global bond yields remained elevated. US treasuries (BBG US Agg Gov) managed a 2.4% return in GBP but only 0.6% in USD. UK Gilts (BBG sterling gilt index) however finished the year down 4% while the longer duration volatile UK inflation linked bonds (ICE BofA UK gilt inflation linked) closed down 8.6%. Shorter term bonds outperformed . The bond market continues to be worried about the imposition of tariffs by the Trump administration which will boost inflation further . Core inflation as well in the US and the UK remains stubbornly above 3% , a headache for central bankers as it limits the extent of future interest rate cuts.

Diversification means constantly having to say you are sorry. Yes, American Equities have been the place to be and are now above 65% of global market indices. However a sizeable valuation gap has now emerged versus the rest of the world. Will this gap close this year and in the future ? Will the technology sector continue to surprise us positively or is all the good news in the price? We honestly don’t know. Owning global equities in their market cap weighted proportions is our way of staying humble, affirming our belief in global market efficiency and letting the markets decide.

Government Bonds , despite a rocky few years, are one of the best ways to reduce excessive volatility in investment portfolios for those who wish to do so. Real yields are the highest for almost twenty years and bonds are still considered a perfect hedge against a market crash and a possible recession (which unfortunately nobody can rule out).

Once again we encourage investors to think long term and always in the context of their own financial plan.

Bring on 2025!

- This blog is for information purposes and does not constitute financial advice, which should be based on your individual circumstances.

- Past performance is used as a guide only; it is no guarantee of future performance.